In early November, the NDP announced that they would propose a new tax on the richest people in the country. The party proposed two measures: a one per cent tax on all wealth over $20 million, and a windfall tax on “excess profits” made by companies that benefited from the pandemic. It is true that so far, it is the workers, especially the poor workers, who have suffered the most from the pandemic, while the richest have become richer. We have said it from the beginning: the bosses must pay. But is a tax—a one per cent tax—the best way to do it, or should we go further?

Growing inequality

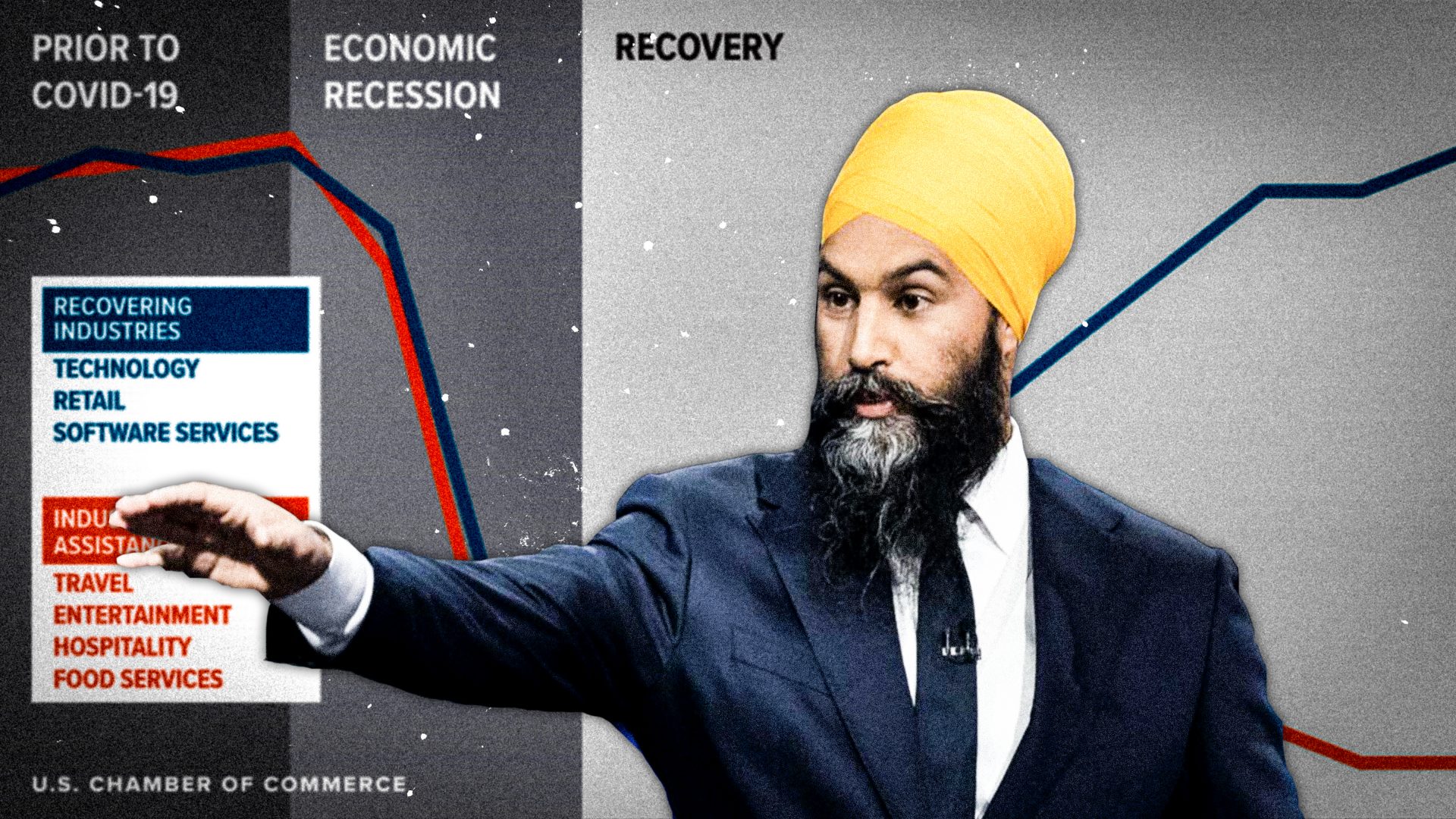

Last September, the Canadian Centre for Policy Alternatives reported that Canadian billionaires have become richer by almost $40 billion since the beginning of the pandemic. On the other hand, thousands of workers have lost their jobs. Tenants across the country are struggling to pay rent. Two-thirds of Canadians in debt can no longer pay their debts or have to make sacrifices to do so. In every way, the rich are getting richer and the poor are getting poorer. We are experiencing a “K-shaped economic recovery” that is deepening the chasm of inequality and hitting poor, marginalized and young workers the hardest.

It is not surprising then, that the idea of a wealth tax is becoming more and more popular. An Abacus Data poll released on Nov. 19 showed that 79 per cent of Canadians support or strongly support a one per cent tax on those with more than $20 million in wealth, and 68 per cent support a tax on excess profits caused by the pandemic. These figures reflect the wave of discontent of the general population towards the growth of inequalities.

Socialists welcome this sentiment with enthusiasm. However, we must also realize that such measures will not address the root cause of rising inequality. In fact, they are far too modest and, in the end, may simply amount to nothing at all.

Tax the rich, but not too much

Let’s first talk about the one per cent tax. Isn’t that figure tiny? Most Canadian families are taxed at a rate that is dozens of times higher—and they don’t have a $20 million fortune! The working class must take back what it deserves; but it deserves more than a few crumbs.

According to the Office of the Parliamentary Budget Officer (PBO), the new tax would be paid by approximately 13,000 families across the country and would raise $5.6 billion. We are told that it’s something, at least. But what does $5.6 billion really amount to? On Nov. 16, the NDP put forward a symbolic motion on the two new taxes in Parliament. Their proposal mentioned that “the billions of dollars recouped from these measures [would allow the government] to: (a) expand income security programs to ensure all individuals residing in Canada have a guaranteed livable basic income; (b) expand health care, including by putting in place a national dental care program and a universal, single-payer, public pharmacare program; and (c) meaningfully implement the right to housing.” Income security, expanded health care and the right to housing are all incredibly important reforms that the working class must win. But $5.6 billion cannot fund this. For example, a government report shows that universal pharmacare would cost about $15 billion annually. And what about guaranteed minimum income, dental insurance and housing rights? Clearly, one per cent is just not enough to pay for what the working class needs.

However, there is a method to the NDP’s madness. Right-wing economists have (correctly) critiqued reformist tax hikes as leading to capital flight. In this instance Marxists agree with the orthodox capitalists. If you tax the rich, they will not invest and the entire capitalist economy grinds to a halt. They will take their money to a tax haven in the Caribbean while workers in Canada are laid off. In response, the NDP has done some clever math and determined that one per cent of $20 million is cheaper than the headaches and expense of hiring corporate accountants to hide their bags of cash.

The trouble with the NDP’s logic is that it leads to a pathetically small amount of money, not to mention it underestimates the petty vindictiveness and political hostility the capitalists will have towards a reformist government. We shouldn’t forget that Conrad Black led a campaign for a capital strike against the equally moderate measures of the Bob Rae NDP government in the early 1990s. The bosses would likely resist this minor measure even if it costs them more money to do so.

In fact, they are already resisting. On Nov. 16, Liberal, Conservative and Bloc Québécois MPs joined forces to reject the NDP’s purely symbolic motion on the two new taxes. There is nothing abnormal about this, since these parties represent the Canadian and Quebec bourgeoisie. The ruling class does not want to concede an inch to these new measures, out of fear of raising hopes in more radical measures later on.

It would seem that the NDP bureaucrats, who have lost all will to fight, greatly underestimate the opposition of the capitalists. They thought that they could make the rich accept giving up crumbs of their own wealth willingly, after a good cordial discussion in the virtual House of Commons. On the contrary, such measures—and much bolder ones—can only be won through class struggle.

Pandemic profiteers

As for the tax on excess profits, this idea is a bit more interesting. It is completely ridiculous that large companies took advantage of a pandemic that caused massive job (and life) loss to reap even more profits than usual. For example, Loblaws has reaped net profits of more than $700 million in the third quarter of 2020, which is an increase of about three per cent compared to the same period last year. Galen Weston and his family, who own Loblaws, have increased their own personal wealth by more than $1,6 billion since the beginning of the pandemic. At the same time, the ‘’hero pay’’ program was cut in June and workers were brought back to poverty wages.

An excess profits tax would be a positive step forward. But again, the NDP should have gone further. Jagmeet Singh mentioned in an interview that, for excessive profits, the corporate tax rate should be doubled, which would take it from 15 per cent to 30 per cent—not counting the various reductions which many companies exploit. But 30 per cent is not enough: all the extra profits due to the pandemic should be expropriated and used to protect the weakest, invest in health, improve contact tracing, contribute to research for a vaccine, maintain the salaries of people laid off, provide protective equipment, etc. The ruling class likes to say that “we are all in this together”. If that is true, then those who have benefitted the most can help out those who have sacrificed the most.

It is completely scandalous that a minority of shareholders continue to line their pockets while the lack of sufficient health and safety measures causes deaths. And it is even worse that it is precisely because of the pandemic that they are getting rich. There is no justification for this.

How can we make the bosses pay?

Socialists welcome the enthusiasm for taxing the richest. The population is pointing in the right direction: the bosses must pay. However, a reformist program of increased taxation is not sufficient. Faced with higher taxes, the rich would simply hide their wealth in offshore accounts, stop investments and move their activities elsewhere. This would only mean job losses for Canadian workers.

The right then says: there you go! Low taxes and a free market is the only way! This ignores the fact that the current crisis has shown that the free market is completely incapable of showing a way out. When the first lockdown happened, hundreds of non-essential companies immediately laid off their workers. When they were bailed out thanks to the emergency wage subsidy (which the NDP scandalously supported), they hoarded the money in order to protect the most important thing under capitalism: their own profits. Production for profit is the fundamental cause of the rise of inequalities and the infamous ‘’K-shaped recovery’’.

Is there no solution then? Fortunately, Marxism has the answer: the rich must be forced to pay, and if they try to run away with their money and take hundreds of jobs with them, then we must nationalize their companies. This is the only realistic solution to the problem of capital flight, no matter how much the “pragmatic” reformists try to avoid it.

Some will say that we cannot afford to pay for these nationalizations. But we have already paid for these companies. In every crisis, including this one, billions of dollars come directly out of taxpayers’ pockets to save the poor capitalists from bankruptcy. We have already paid a hundred times through decades of bailouts, tax cuts, corporate welfare, wage theft, tax evasion, and through the unpaid labour of the working class, on which the capitalists depend for their existence. These companies should belong to the working class. That is why Marxists say: nationalization without compensation.

No bailouts, only nationalizations

The COVID-19 pandemic has greatly exacerbated existing inequalities, and more and more people are coming to the conclusion that the richest must pay for the crisis. However, tax reforms are not enough: as long as the economy remains in the hands of the ruling class, they will find a way not to pay.

The only solution to this situation is to take the economy into our own hands. Companies on the verge of bankruptcy should not be bailed out with public money, but should be nationalized under workers’ control to save jobs. These companies could then be integrated into a rational and democratic socialist economic plan, whose first aim would be to meet the needs of the population, not to satisfy the greed of a few. This would stop the growth of inequalities at the source and would allow significant improvement in the fight against the pandemic.

We say: no bailouts, only nationalizations. This slogan, vigorously defended in the movement by the NDP, QS, the unions and the rest of the left, could very well connect with the anger that is accumulating more and more in the population. It is the only way out of the crisis for workers.