When Carney came to power, many felt that his credentials as a central banker meant that he would be best suited to tackle the economic crisis brought upon by Trump’s tariffs. But it has become clear that Carney has no solutions, and the Canadian economy is barreling towards disaster.

Dependent on America

The success of Canadian capitalism for decades has relied on America. With 80 per cent of Canadian exports traditionally sold in the United States, Trump’s tariffs present a mortal threat to major industries all over the country. In particular, softwood lumber, manufacturing, aluminum, and steel all stare destruction in the face.

Capturing the gravity of the situation, Carney has repeatedly called the situation facing the Canadian economy “not a transition” but “a rupture.” And this is quite right. What was once a huge strength has now become the Achilles’ heel of the Canadian economy.

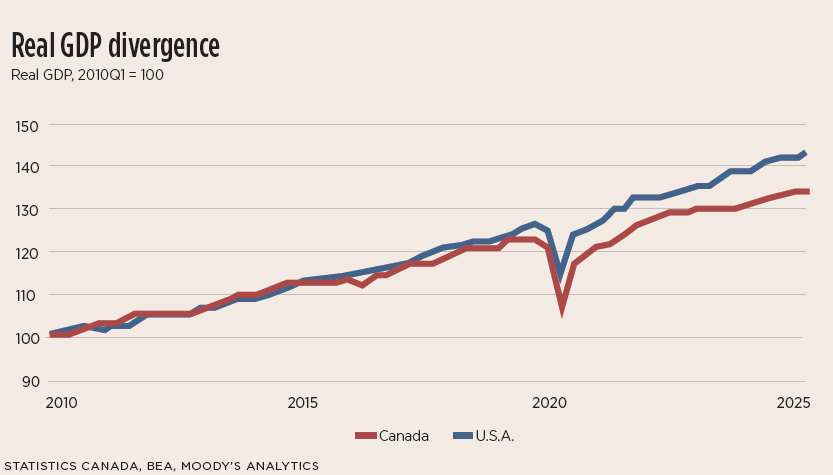

As American imperialism abandons the so-called liberal world order established after WWII, Canada is one of the biggest losers. A recent analysis published by Moody’s shows that while in the past the Canadian economy would benefit from American prosperity, that is decreasingly the case.

And while Trump accelerates this trend, it actually predates him. As the Moody’s report notes, Canadian and American GDP grew at approximately the same rate between 2010 and 2017 (18 and 20 per cent respectively). Since 2022, however, this has changed. While U.S. GDP growth over that period was 6.7 per cent, Canadian growth was just 3.6 per cent.

Industrial implosion

At the heart of this economic crisis is the decline of Canadian industry. As China has become an industrial powerhouse and mass exporter, America has looked to protect its industries and has no time to save those of its former allies like those in Europe or Canada, which are both getting squeezed out.

There has been an exodus of capital investment, both Canadian and foreign, from the Canadian market. Theo Argitis, senior vice-president of policy at the Business Council of Canada, explains, “We live in a world where capital is becoming increasingly sparse; there’s a lot of competition for capital out there.”

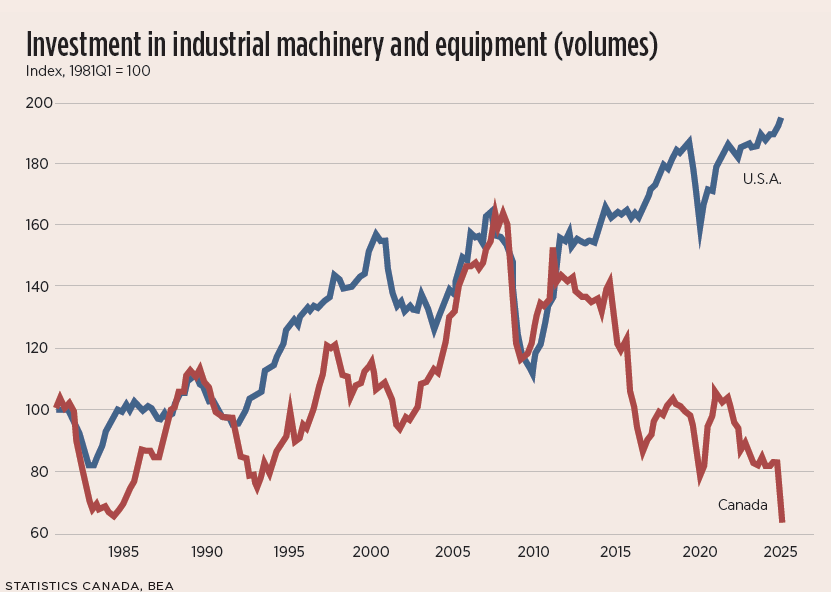

The result is what the National Bank calls an “industrial implosion.” While investment in industrial equipment and machinery has risen steadily in the United States, in Canada it has cratered to its lowest level on record (see chart). This has led to a crisis in labour productivity. Since 2022, U.S. labour productivity has grown by 5.6 per cent, while it has fallen by 1.2 per cent in Canada. Tariffs have accelerated this process with labour productivity dropping by one per cent in the second quarter as the economy contracted by 1.6 per cent.

Across Ontario, auto production has halted and factories have closed, costing thousands of jobs. Without the benefit of free access to the American market, companies like GM and Stellantis are moving their factories south of the border.

A similar crisis faces steel, aluminum, and softwood lumber. Even industries not directly targeted by Trump have suffered from the decline in relations between the two countries, like Air Canada, which just laid off hundreds of workers as flights to the U.S. have plummeted.

As Jason Jacques, the parliamentary budget officer, ominously put it, the economy is “looking out over the cliff.”

The result for working class people is dire. The unemployment rate has increased to 7.1 per cent, the highest since the pandemic, and the youth unemployment rate is almost 15 per cent, the highest in a decade and a half. As capital flees the Canadian economy, the number of jobs available has plummeted to the lowest it’s been in eight years. Unsurprisingly, the gap between the rich and the poor has also shot up to the highest it’s been on record according to Statistics Canada.

Carney helpless

Carney promised to stand up to Trump. He promised he would diversify trading partners, lessening the dependence on the United States. He promised he would build an “east-west energy corridor” and turn Canada into an “energy super power.”

And with a dose of utopian optimism Carney claimed he would build Canada into “the fastest growing economy in the G7.” Finance Minister François-Philippe Champagne has even gone so far to suggest that they could rebuild the economy and unleash a new economic boom like the one following WWII.

But this is all wishful thinking.

The post-war boom was an anomalous situation produced by the result of WWII. The destruction of WWII created a massive crisis of underproduction—creating the conditions for the unprecedented post-war economic upswing. In addition to this, the United States became the unipolar capitalist power, imposing itself on the world and bringing down trade barriers.

But we are facing a situation that in many ways is exactly the opposite. It is not the unipolar world it once was and the United States has to contend with other powers, principally China, which has become their main rival economically.

There is a huge crisis of overproduction that plagues the global system, and different capitalist powers fight each other over markets. In this context, Canada is no longer able to ride the coattails of American dominance as they scuttle old allies in a move to put “America first.”

Carney does not have a magic wand he can wave, and do away with this material reality. While Carney has made a lot of noise about diversifying trading partners, it will ultimately be impossible to replace the American market—especially in conditions of widespread protectionism. Already, Canadian agriculture is suffering from China’s tariffs on canola and India’s tariffs on yellow peas.

Things are even worse for things like steel, aluminum and automobiles. The whole problem stems from the fact that Canadian and American vehicles and steel (among other things) cannot compete with Chinese vehicles and steel.

The far-sighted bourgeois see this and are counseling Carney to break bread with Trump. For example, in an article entitled “Canadians would be wise to listen to what the U.S. ambassador has to say”, Business Council of Canada president Goldy Hyder wrote the following: “Many things have changed this year, but two haven’t: geography and math. Those highly integrated supply chains run north and south, and the undeniable truth is no amount of trade diversification can replace the value and volume of goods they carry—not in our lifetime.”

He therefore puts forward the perspective of an increase in trade and investment as a result of the United States–Mexico–Canada Agreement negotiations next year. But this seems highly unlikely without massive concessions to Trump.

This is why, far from fighting Trump, Carney has bent over backwards to slavishly ingratiate himself to him, making concession after concession. He removed counter tariffs and eliminated the digital service tax against U.S. tech giants. Even his military spending and border plans are obvious capitulations to Trump.

To justify the massive ramp up in military spending, Carney claims that it will “build domestic manufacturing and supply chains, and create new careers.” But these tens of billions will only make negligible contributions to Canadian industry as the bulk of that spending is going to companies based in the United States.

Carney has also come up against the exact same barriers internally that Trudeau grappled with. In spite of making a lot of noise about building an “east-west energy corridor,” no private company seems willing to invest in such a venture.

This has led the Alberta government to propose itself as the initial funder of a new pipeline, only to have this ruled out by the government of British Columbia as well as Indigenous groups. So instead of building energy infrastructure from east to west to reduce reliance on the American market, Carney has suggested reviving the Keystone XL pipeline to America—which will further increase dependence on America.

Class war inevitable

The unavoidable conclusion is that we are facing an unmitigated disaster and the government has no solutions. And we, the working class, will be the ones made to suffer through job losses and cuts to social services.

The budget announced by Finance Minister Dominic Champagne cuts 40,000 federal government jobs. In the private sector, the situation is even worse.

In this investment environment, with a breakdown in world trade and fierce competition, Canada simply is not a competitive market to invest in. This is why many companies are pulling out their investments, in search of more profitable markets.

The problem is underlined by using the example of the Canadian Pension Fund, which at the current moment has only invested 12 per cent of its funds in Canada. John Graham, chief executive of the $730 billion fund explained why: “capital is fluid and mercenary. It will always flow to opportunities of least resistance.”

Therefore, to attract capital investment, federal and provincial governments must eliminate as many barriers as possible. This includes regulations, taxes and the cost of labour. Already Carney has torched many environmental regulations. His latest budget eliminates the luxury tax and includes massive corporate tax write offs in what they call the “productivity super deduction.”

In the cross hairs of the ruling class will inevitably be the labour movement. The capitalists must bring down the cost of wages and benefits. Union rights are violated left, right and centre by both federal and provincial governments because they can no longer tolerate higher wages and benefits or the economic disturbance caused by strikes.

We are looking down the barrel of massive public austerity and huge factory closures and layoffs in the private sector.

The class war is coming our way—we must be prepared to wage it.