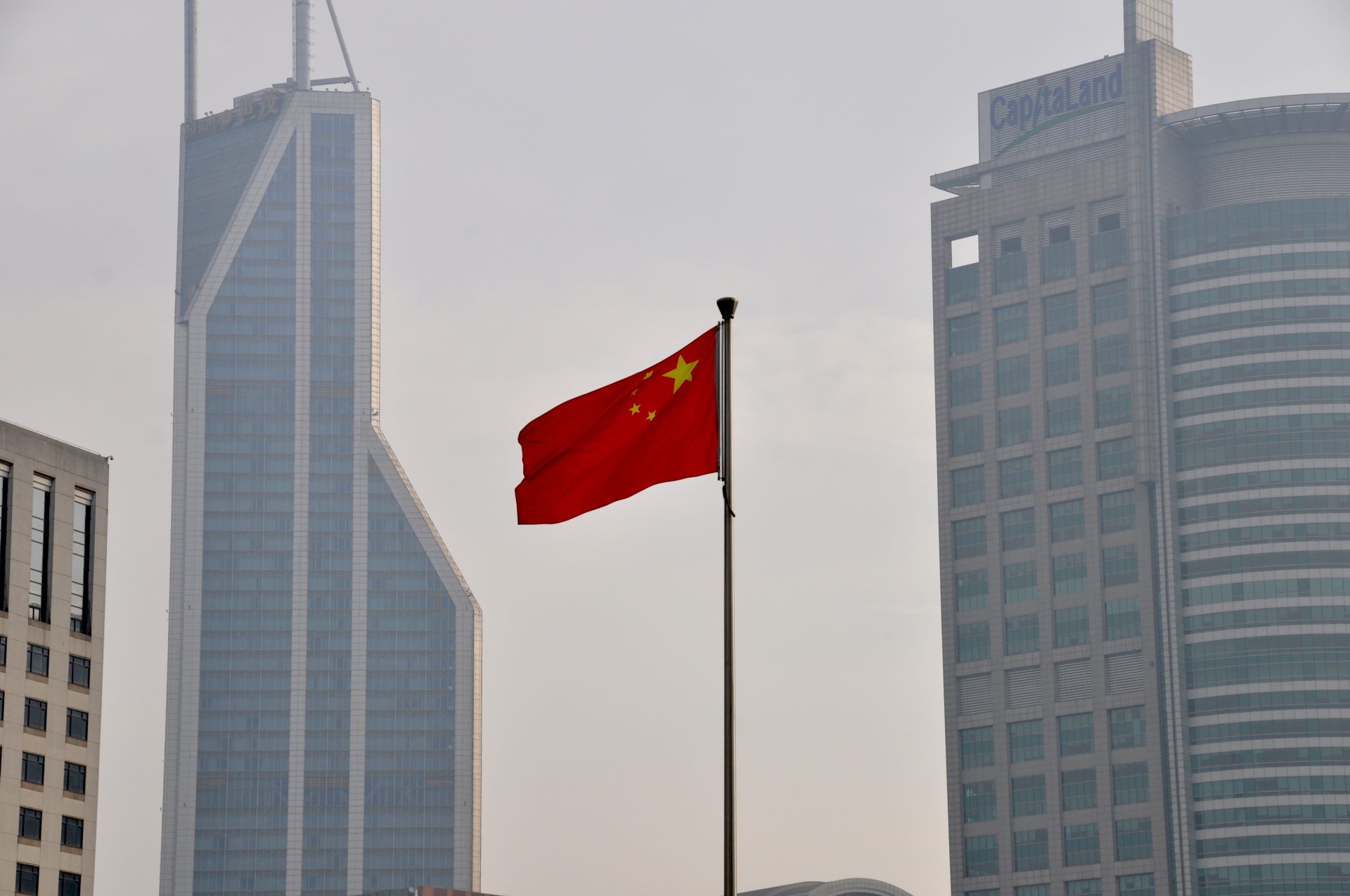

China has surged ahead as the world’s premier industrial power. Not a day goes by without news of new technological breakthroughs made in China.

This country, which only two decades ago was still mired in backwardness, is now engaged in a titanic rivalry with the US in which it is holding its own. Meanwhile, American imperialism, by far the strongest power on the planet, is at a dead end, bound up in a web of contradictions.

This rivalry is now the main axis around which the world situation revolves today.

How did the Chinese economy manage to do this? And what does this mean for the crisis of world capitalism?

An unmistakable rise

In a world economy characterised by stagnation, China’s GDP growth has recently hovered around five percent, a substantial expansion in absolute terms for an economy now three times the size of Japan’s. More importantly, this rate far outpaces the older imperialist powers: the United States is growing at 2.8 percent, while the EU stagnates at just 0.1 percent, with its industry in decline.

Unlike many of the old imperialist powers whose industries slacked and decayed in favour of finance capital, China’s industrial sector remains vibrant and is already reigning supreme on the world scale. According to The Economist, China alone accounts for 30 percent of the world’s manufacturing, more than the US, Germany, Japan and South Korea combined. There is no sign of stopping, as China’s value-added industrial output, or new value created by industry, continues to grow at around five to six percent yearly.

One should also look at what China produces today. Gone are the days when China only produced low quality clothing, toys, and daily accessories. The words ‘Made in China’ are now linked with the world’s most advanced tech products. Since 2020, China has been dominating the world’s production of computers and electronics, chemicals, machinery and equipment, motor vehicles, basic metals, fabricated metals, and electrical equipment.

Moreover, China has become a powerhouse in research and innovations. Today, seven out of the world’s top 10 research institutions, according to Nature Index, are Chinese. It dominates the field of robotics both in patents filed (two thirds of which are from China) and in number of robots installed, with more than the rest of the world combined. ‘Dark factories’, nearly fully roboticised factories that employ so few workers that no lights are required, are being implemented in many fields of manufacturing.

Even in sectors where it faces bottlenecks in upgrades due to vigorous undermining from the US, such as the semi-conductor industries, China’s self-sufficiency continues to improve rapidly. The US’ attempts to blockade China from the most advanced technology in this field are rather serving to push forward China’s development of cutting edge alternatives to manufacturing advanced microchips.

While most of these innovations have been applied to consumer goods, application on military use is quickly following. To name just a few, China has rolled out drones that can both swim under water and fly in the air; large underwater drones; and jet-propelled drones that could allow any warship to function as an aircraft carrier. All of these developments are humiliating and terrifying China’s competitors in the West.

The picture is crystal clear: China is developing on an enormous scale that is challenging the US’ dominance in many spheres. It has long cast off dependence on foreign investments and reliance on low-value added manufacturing to become a powerful imperialist country. How was this achieved? Can this development continue without contradictions?

‘Privileges of backwardness’

A key material factor that explains China’s astounding progress lies in its starting point.

Whereas older capitalist countries are carrying the burden of the years of accumulated contradictions, inefficiencies, debts and other problems with the forces of production, China was a backward country (though with an important industrial base) compared to the West, when it joined the world capitalist market. High tech industry was non-existent and could be built from the ground up.

Yet, China did not need to develop industry from scratch. From the outset, it could implement the most advanced techniques available from around the world.

This was a part of the uneven and combined development of capitalism as a world system, which Trotsky observed long ago in Russia:

“The privilege of historic backwardness – and such a privilege exists – permits, or rather compels, the adoption of whatever is ready in advance of any specified date, skipping a whole series of intermediate stages. Savages throw away their bows and arrows for rifles all at once, without travelling the road which lay between those two weapons in the past. The European colonists in America did not begin history all over again from the beginning. The fact that Germany and the United States have now economically outstripped England was made possible by the very backwardness of their capitalist development. On the other hand, the conservative anarchy in the British coal industry – as also in the heads of MacDonald and his friends – is a paying-up for the past when England played too long the role of capitalist pathfinder. The development of historically backward nations leads necessarily to a peculiar combination of different stages in the historic process. Their development as a whole acquires a planless, complex, combined character.”

Shenzhen, now China’s third-largest city, is the clearest example of this transformation. In 1980, it was little more than a fishing village of 30,000 people. Designated as China’s first ‘special economic zone’ in a step toward capitalist restoration, it rapidly grew into a hub for telecommunications equipment by the mid-1990s, and by the early 2000s had become the ‘world’s factory floor’, churning out cell phones for western brands.

With deliberate state intervention, Shenzhen attracted massive investment and skilled labour, enabling it to upgrade to higher-tech industries. Today, it is celebrated as the ‘Silicon Valley of China’. All of this unfolded in just four decades.

There are abundant examples of China benefiting from the privilege of backwardness, otherwise known as ‘latecomer’s advantage’. The Tiangong Space Station, China’s independently operated station and one of only two currently operational space stations, was built using the latest research and lessons from the U.S. and Russian space programmes. Similar progress has occurred in China’s information and communications technology, high-speed rail, and rare earth mineral refinement, among other sectors.

China fully recognises and exploits this advantage. As Fan Gang (樊纲), president of the state-run China Development Institute, plainly explained:

“Every year the country spends more than $30 billion purchasing IP or licensing rights; and it voraciously learns and imitates unprotected knowledge. As a late-bloomer, it can access such knowledge faster and cheaper. And imitation is not shameful.”

But such ‘privileges of backwardness’ alone far from explain China’s continued success. There are plenty of countries in the world that remain trapped in backwardness and cannot seem to get out of it. Another key factor for China to be able to do so lies in the role of the CCP state.

The role of a bonapartist state

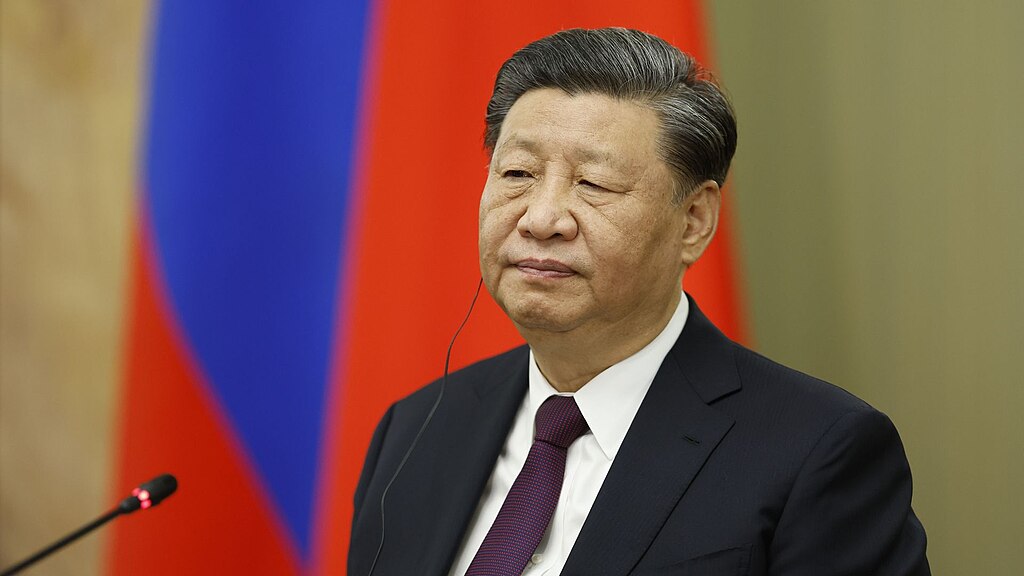

China is ruled by a single-party dictatorship under the Chinese Communist Party. While the state upholds capitalism and represses the working class, it also intervenes forcefully in the market, keeping the bourgeoisie in check and compelling them to follow its directives on how to behave and invest their capital.

The party-state controls several key levers of the economy. Unlike in most capitalist countries, the central bank’s monetary and fiscal policies are directed by the party. The state also holds majority ownership of the country’s largest commercial banks – four of which are now the biggest in the world – allowing their capital to be deployed in line with state policy first, before considering the short-term profits of shareholders. In addition, the state sets development goals for the economy and compels the private bourgeoisie (i.e. capitalists who own enterprises that are not owned or controlled by the state) to comply through subsidies or regulation.

Capitalists whose actions threaten systemic stability are also swiftly curtailed. For example, when Alibaba CEO Jack Ma attempted to launch the risky financial venture Ant Group – which raised a whopping US$34 billion from investors – the state intervened, halting the project and temporarily forcing him into exile. The authorities judged that Ant Group exhibited many of the traits seen in large western financial firms, including the questionable schemes and reckless executive practices that had previously triggered crises like that of 2008. Ma was also becoming a symbol of vast inequality in Chinese society. They chose to address the risk early, before it could escalate.

Jack Ma’s personal conduct also drove the CCP to act. At the time of the launch of Ant Group, Ma publicly complained that there had been overly restrictive regulation on the financial sector. Given his celebrity and wealth, such a public complaint amounted to an open challenge to the authority of the CCP, a deed that could not go unpunished, despite the fact that he was a card-carrying member of the CCP. The CCP also stood to gain some popularity from the masses in this, as Jack Ma was already widely hated for being an arrogant, unabashedly rich man.

This disciplinary measure against an individual capitalist was no isolated incident. In the same year that Ma was flogged, the CCP fined a range of Chinese firms which involved hundreds of millions of dollars, which also weighed on share prices and cost investors over one trillion US dollars. In 2024, according to state media Global Times, the total cost of penalties issued increased to a sum of $1.52 billion. Additionally, capitalists who declared bankruptcy found themselves blacklisted from future credit loans and were barred from luxury expenditures.

In the West, where the politicians are in the pockets of the rich, the bourgeoisie generally reigns over the state, the so-called ‘rule of law’ is observed, and capitalists are not at risk of being made into an example. Their property is secure, and they do not have to go into hiding if they criticise the government – indeed, it is more often than not the politicians who must bend to the will of the capitalist class.

A comparison between Elon Musk and Jack Ma is instructive. Both are megalomaniacal tech billionaires with an irrepressible urge to broadcast their opinions to the world. Yet the outcomes they have faced are markedly different: Musk could buy political influence, clash with a President of the United States, and still see his wealth and state contracts remain intact, while Ma was sidelined for years and stripped of a significant portion of his business empire by the CCP.

Besides severe punishment, the CCP state also uses a carrot and stick approach, to push the market in a certain direction. There are massive subsidies, tax cuts, and other measures given to sectors that the state favours, which are often led by public-private joint ventures with regional governments. The state also deploys party cadres and its apparatus into the private enterprises themselves, especially those they deem to be ‘industry leaders’, to ensure that they are behaving in a way that follows state policy.

In this way, the state also ensures that less capital flows into risky and unproductive sectors, in particular the finance sector. Whereas in the West, billions have been pouring into stock-buybacks or one crypto fad after another, in 2017 China banned domestic mining and trading of cryptocurrency despite being the world’s largest cryptocurrency market at the time.

The Chinese state’s relative independence from more immediate bourgeois interests also affords it more tools to alleviate potential slumps and crises. This was how Evergrande’s default crisis was dealt with, to prevent a domino effect on the rest of the economy.

Shortly after Evergrande’s default became public, the state stepped in to form an opaque committee to clean up the crisis. State owned enterprises and several private enterprises alike were mobilised to take up parts of Evergrande’s debt and finish their unfinished projects, while freezing the hundreds of millions of dollars worth of assets of its CEO Hui Ka-yan. In this way, although the problem is still ongoing and China’s real estate sector continues to exert a downward pressure on the economy, a full blown crisis was halted.

In contrast, when Lehman Brothers went into crisis after years of unchecked risky practices, the US government was not able to stop it from collapsing, which tanked the world economy. Yet, in the aftermath, the US Federal Reserve still had to shell out billions to rescue other companies to prevent a domino effect, while the CEO of Lehman Brothers got to keep hundreds of millions in salary and bonuses.

The state also took measures to direct investment away from real estate and into manufacturing, which it thinks can move the economy away from higher risks.

Disciplining the bourgeoisie however is only one side of the story. The Chinese state is above all concerned with suppressing the working class.

It never gave the masses genuine democratic rights, and in recent years has exercised even tighter control. Online censorship is not only omnipresent but constantly reinforced by improved surveillance technology. Of course, any attempt at organising trade unions outside of the state trade union structures is ruthlessly suppressed.

As there are no genuine workers’ organisations, projects such as installing Dark Factories, which threaten the jobs of workers, can go unchallenged.

But the state also keeps the other side of the class divide in check, to maintain the overall stability of the system. Sometimes, the state intervenes in workers’ disputes with the bosses on the side of the workers, in order to prevent ferment from increasing. Recently, the state has also pushed for the raising of the minimum wage, partly to boost spending to combat deflation, but also partly to diffuse class anger.

The CCP was able to achieve all of the above because prior to the restoration of capitalism in China, it was already a powerful, all-pervasive police state. The fact that the CCP, unlike its counterpart in the Soviet Union, tightly controlled the process of capitalist restoration, meant that it maintained its powerful position in Chinese society as capitalist restoration took place, whilst the state in the Soviet Union collapsed.

In the process of transforming China from a planned economy to one dominated by market forces, the profit motive, and private property, the CCP kept the main levers of the economy, especially the banks and certain strategic industries, under the state’s control. Foreign investment is welcomed, but kept out of outright ownership of enterprises.

On the one hand, the state bureaucracy is not interested in allowing its power to be usurped by foreign imperialists or a layer of the bourgeoisie. On the other hand, it also needs to suppress the working class in the service of capitalism as a whole, and thus has no interest in allowing the working class the rights of bourgeois democracy, such as the right to form independent trade unions.

The CCP bureaucracy has to permanently balance between the bourgeoisie and the working class – which Marxists refer to as ‘Bonapartism’, where the state raises itself above any one class and rules directly by police methods – in order to preserve the existing system as a whole.

The Bonapartism of the Chinese state, however, has very specific causes and characteristics. Marx’s definition of Bonapartism pertained to countries in which the class struggle is at a deadlock. In this scenario, a ‘strongman’ emerges, who offers to reestablish order on the basis of enhancing the repressive powers of the state, but in doing so is able to gain a large degree of independence from the ruling class, even though ultimately the reestablishment of order is in the latter’s interests.

The Bonapartist regime in China today did not stem from a deadlock in class struggle, but stemmed from a bureaucracy that previously siphoned off the gains of the planned economy and later restored capitalism and based its privileges and interests on capitalism. This could not have been done in China without continuing the suppression of political freedom of the workers. At the same time, it gave birth to a layer of capitalists who find themselves dependent on this state.

The presence of this Bonapartist state that can heavily intervene in the market and discipline the behavior of the capitalist class, alongside the ‘youthfulness’ of the Chinese economy, gave China a significant competitive edge over its western adversaries.

“The Apollo Spirit”

With its weight in society, the CCP state can spearhead research and development projects on a national scale, coordinating efforts with remarkable speed – ironically in a manner not unlike how the United States organised its own push during the Space Race.

As Harvard University faculty member Bruno Sergi noted in The Diplomat, a decisive factor behind NASA’s success in the Apollo Project was not free market competition, but centralised state leadership. NASA oversaw a streamlined process of research, development, manufacturing, and implementation, with private companies largely subordinated to state direction.

In the race for AI, China is doing something similar. As Sergi explained:

“Since the State Council’s 2017 ‘New Generation Artificial Intelligence Development Plan,’ Beijing has set explicit milestones for 2030 leadership, backed by large-scale investments in research institutes, university programs, and industrial parks. Chinese universities are intertwined in applied R&D, registering patents, and partnering with tech giants like Baidu, Alibaba, Tencent, and Huawei to commercialize breakthroughs. China can deploy extensive facilities, data centers, and streamlined approvals at a speed that any Western benchmark would envy.

“China is hedging against chokepoints, shielding itself from U.S. export controls on advanced semiconductors by accelerating domestic chip fabrication. Huawei is leading the production of new AI chips and Ascend processors, with plans for dedicated fabrication and scaling, primarily through SMIC. Alibaba and Baidu are developing domestic AI accelerators to lessen dependence on imports.”

But the same spirit of concerted state direction goes far beyond AI. In the ‘Made in China 2025’ initiative, first introduced in 2015, the Chinese state identified tech sectors in which to make decisive investments and coordinated efforts, in order to upgrade Chinese industry’s technological competitiveness and independence. As of 2024, over 86 percent of the goals of Made in China 2025 were met, which are expressed in the kinds of achievements we have mentioned above.

All of this underscores a fundamental point: contrary to the free-market evangelists, given the enormous division of labour required to advance the productive forces today and the scales involved, centralised state intervention is far superior to the market in driving technological innovation. The CCP is now leveraging this capacity in AI development to advance its own interests as a capitalist world power, competing head-to-head with the West – and making undeniably rapid progress.

Is this a planned economy?

It is clear that the Chinese state today is able to set concrete economic goals and direct the economy to meet them. A degree of planning is clearly involved.

Given this fact, coupled with the fact that the ruling party is still nominally a Communist Party, which characterises the economic system of China not as ‘capitalism’ but as ‘socialism with Chinese characteristics’, one may be tempted to ask: is the China of today a planned economy?

In a nationalised planned economy, what would drive economic activity would not be the same as under capitalism. Key levers of industries would be nationalised, while production would be organised according to a concrete plan that directly supplies the needs of society as a whole, rather than pursuing profit.

Because of this, there would no longer be an anarchic market with its crises of overproduction and cycles of boom and bust. Of course, a healthy planned economy requires the check of workers control to ensure that waste, mismanagement and corruption does not proliferate.

In the past, China did have a nationalised planned economy, albeit one that lacked democracy for the working class and was dictated by the bureaucracy. It scored enormous gains for China, freed it from imperialist domination and backwardness, and brought it into the modern age.

In the decades since, many features of the past planned economy were destroyed by the CCP itself. Guaranteed employment, housing, and social care are now distant memories. Although vestiges of that past are still present – such as state ownership of several important levers of the economy – everything in China, including state owned enterprises, primarily operate in pursuit of profit and market share, rather than to fulfill social needs.

Industrial plans, such as Made in China 2025, are plans to ensure that Chinese products can outsell other countries’ capitalist enterprises on the world market. This is the fundamental point: despite heavy state intervention, it is the pressures of the market and profitability, two basic pillars of a capitalist economy, that ultimately determine how the economy functions.

Even though the state can steer the economy towards its objectives by incentivising and disciplining capitalists and even by directly developing certain technologies, the market economy constantly undermines or alters the outcomes the state strives for. This typically takes the form of massive overproduction, and the resulting deflation, owing to the rush of investment into sectors favoured by the state.

These outcomes have become so widespread that a special term for it, ‘involution’, has caught on, and has even been spoken of by Xi Jinping himself. This refers to the unwanted effect of excessive competition in favoured sectors, whereby it becomes extremely difficult simply to break even and stay up to date with competitors.

So much money floods into these sectors that highly productive firms are still unable to gain market share, since rivals are doing exactly the same. The result is price wars, long working hours, and massive overproduction. This tendency will be worsened by China’s recent push for world-leading technological advancements.

The foremost example of this is the massive overproduction of electric cars. State policies and subsidies in recent years rapidly cultivated a handful of electric car brands with enormous productive capacity, which led to a glut of electric cars in the market. The urge to sell these cars led to a chaotic price war, which is forcing the companies to operate at a loss and become even more dependent on state support, rather than less. In this way, the state is becoming the victim of its own success.

A nationalised planned economy would have been able to immediately retool these industries to supply other needs in society. For example, these factories could easily be reconfigured to produce necessary electronic or computer products to supply the poorest regions of China at a low cost or for free, in order to balance out the enormous regional inequality.

Instead, all that the state can do is regulate regional governments’ subsidy policies and allow certain companies to fail. This is far from a speedy process and is difficult for the central government to implement, despite its powerful apparatus.

Car brands are finding other ways around the state edict to halt price cuts and to continue the sales spree, such as giving car buyers zero-interest financing, free cellular data, and others. The China Automobile Dealers Association has explained that, in order to achieve the desired effect, the CCP must be prepared to wage a prolonged battle.

All of these are a natural part of capitalist development. There is nothing ‘characteristically Chinese’ about this. Marx and Engels wrote extensively about new industries with high profit rates being overrun by investments, which in turn push profits down and cause a crisis in that sector. This in turn leads to bankruptcies and the consolidation of the sector by a few monopolies. In Lenin’s Imperialism: the Highest Stage of Capitalism, he cited the following description of British imperialism at that time:

“Every new enterprise that wants to keep pace with the gigantic enterprises that have been formed by concentration would here produce such an enormous quantity of surplus goods that it could dispose of them only by being able to sell them profitably as a result of an enormous increase in demand; otherwise, this surplus would force prices down to a level that would be unprofitable both for the new enterprise and for the monopoly combines.”

These words apply just as well to capitalist China today.

At the end of the day, as long as the economic system remains on the basis of an anarchic market, production for profit, the nation state, and private property, no amount of state regulation can forestall the inevitable result of a crisis of overproduction, which is now all too clearly shown in China. The CCP has no solution or plan for this fundamental contradiction.

Limits of capitalism

Despite the stellar growth as a result of the state’s direction, like many advanced capitalist economies, China is seeing a slowdown in its growth rate.

The Evergrande crisis, which weighs on China’s economy – where real estate plays a major role – contributed to the slowdown. Although state intervention prevented a collapse on the scale of the 2008 financial crash, Evergrande’s default problem persists and may take years to resolve, if it can be resolved at all.

Similarly, while the state can attempt to curb price wars, private enterprises and their regional government backers continue to circumvent policies to protect short-term interests and profits.

Without a planned economy, there are no simple or quick fixes for problems arising from the market’s anarchic dynamics.

Also, just as in all capitalist economies in the world, an enormous amount of debt, both private and public, has been accumulated in China. Above all, in late 2024, the Chinese state had to introduce an enormous fiscal stimulus package to buoy consumption and the finance market, which added to the debt burden of the state.

For the masses, the cost of living and unemployment (especially among new graduates) are steadily rising. The pressure upon the youth is particularly acute as China’s aging population places a heavier burden on younger people to take care of their elders.

Social programmes such as social insurance (社保) and medical insurance (医保) are under strain, as more people cannot afford to make the payments. Typical austerity measures, such as raising the retirement age, are being rolled out, although in a very gradual manner.

It would be a mistake to equate the current scale of austerity in China with that of the West. China is only at the beginning of this process, while western ruling classes have been waging such attacks on workers for over two decades, with no sign of retreat. Nevertheless, China is moving down the same path – an inevitable outcome of capitalism that no state, however powerful, can escape.

Underneath all this is a persistent problem of enormous overproduction. Overall industrial capacity utilisation rate is now at 74 percent, the lowest since 2020. The electric vehicle industry, where the problem is particularly acute, only utilised 49.5 percent of its capacity in 2024. As a result, profitability declined. The portion of loss-making industrial firms went from about 10 percent in 2016 to about 20 percent in 2024.

As noted above, domestic overproduction is driving persistent deflation and declining profitability. Ultimately, China will either have to flood the global market with its goods – a trend already underway – or face the collapse of many firms engaged in price wars, threatening millions of jobs.

Prospects for class struggle

The dynamism of the Chinese economy, especially in its industrial sector, contrasts starkly with the US economy, which is chaotically trying to defend its supremacy in the world, or with the European economy that is clearly in decline.

The stark development of China’s productive forces will undoubtedly produce a certain impression among the masses that their lives could incrementally improve under CCP leadership. Indeed, the state media strengthens this impression by showing the worsening lives of the working class in the West, with very little lying or distortion necessary.

The belligerence of the US towards China, which has been recently intensified by both the Biden and the Trump administrations, has also reminded the Chinese masses of the country’s shameful history, when it was carved up and dominated by western imperialists. An anti-imperialist, anti-western sentiment has naturally arisen as a result. This gives the CCP a chance to cynically bolster its support by fanning nationalist propaganda.

How does this all impact class consciousness in China? In the last 30 years, China has been completely transformed, and with it the lives of hundreds of millions of people. In one generation, many have gone from being poor peasants in villages to industrial workers in modern cities, with a much higher standard of living and with the hope that their children will live even better. Furthermore, the country is strong on the world arena and projects power vis-a-vis its rivals.

While some may resent or criticise the CCP, the continued economic growth and perception of western hostility may suppress revolutionary impulses, at least as long as the system appears to deliver.

Yet class struggle never develops in a straight line, nor does it hold a mechanically inverse relationship with economic prosperity. Quite often, a degree of economic growth in turn strengthens the confidence of the working class in fighting for their own interests.

As said, Chinese capitalist society remains rife with contradictions that must occasionally burst to the fore. Earlier this year, as BYD secured its dominance in the world’s electric car market, we saw thousands of BYD workers in China launching fierce struggles against pay cuts.

Other events – such as the mass protests in Pucheng, Shaanxi in January and Jiangyou, Sichuan in August, where thousands rallied against the cities’ bureaucratic mishandling of school bullying, which escalated into a broader demonstration for democratic rights – show that a ferment from below remains very much alive in society, expressing the desire of the masses to control their own destiny and resist bureaucratic dictatorship.

Rising in a declining world

China is clearly surging ahead in many ways, displacing US dominance in one field after another in a struggle for markets around the world. While at this point it remains far from displacing the US, in many ways it has learned to become a better manager of capitalism than the West.

Nevertheless, despite faring better than its rivals, Chinese capitalism is rising while world capitalism is in its most serious crisis in history. It may be able to defend itself from world crises or competition from US imperialism to a certain extent, but it cannot fully extricate itself from the crisis of world capitalism. A slump outside of its borders will inevitably impact China in a significant way. Nor can China indefinitely evade the crisis of overproduction from within.

Above all, the Chinese proletariat – massively strengthened alongside the economy – occupies an unparalleled position on the world stage. Sooner or later, the world will be even more awestruck by the movement of the Chinese working class than it is today by China’s technological advancements.