In response to the current deep economic crisis, previously unthinkable solutions are gaining in popularity. Overnight, the most ardent supporters of austerity have backed massive bailouts. “We are all Keynesians now” is the new watchword of the ruling class. Governments, even if they don’t want to admit it, are in practice adhering to modern monetary theory. The idea of a universal basic income is being seriously considered by those in power. But can such reforms actually solve the crisis?

A deep crisis

The pandemic has dealt a severe blow to the economy. The gross world product fell by 4.3 per cent in 2020. This represents the most severe drop since the Great Depression of the 1930s. In contrast, it fell by 1.7 per cent in 2009, during the worst of the Great Recession. In 2020, the U.K. experienced its worst economic decline in 300 years, which means this is the worst since before the Industrial Revolution! It would therefore be difficult to exaggerate the scale of the crisis.

Whole swathes of economic activity have been put on hold. Millions of workers have been laid off. Governments around the world have had to adopt colossal rescue plans to prevent a complete collapse. At the bottom of the first wave last May, unemployment reached 14.7 per cent in the United States. In November, the European Central Bank warned that a large proportion of European workers were working for companies on the verge of bankruptcy. One in seven Spanish workers were at risk of losing their jobs, compared with one in twelve German and French workers.

The world economy is standing on the edge of a precipice. The only thing that has kept it from falling over the edge has been the injection of massive amounts of government money. But the fundamental problem has not been resolved.

The pandemic was just the final straw that broke the camel’s back. It was a very big straw, yes, but the camel was already overburdened. As early as 2019, the international financial press was already fearing that a recession was coming.

The global economy never really recovered from 2008, and the recovery of the last 10 years was very weak. For example, it wasn’t until 2018-2019 that Europe returned to pre-Great Recession levels of unemployment.

Beyond the statistics, which present only a partial picture of the situation, this is a profound crisis of the capitalist system itself—a system that is failing miserably to address the pandemic, a system unable to address climate change, a system in which the most abject poverty sits side-by-side with the most inordinate wealth.

How can we get out of this crisis? Several solutions are emerging. Some, particularly on the left, see the pandemic as an opportunity to enact significant reforms to address these problems of capitalism. But is it possible to reform capitalism?

Keynesianism

Keynesianism represents the “classic” solution of governments to economic crises. Keynesian policies, inspired by the thinking of the English economist John Maynard Keynes, have been enjoying a strong revival since the new economic crisis broke out.

Mainstream bourgeois economic thought is largely based on the ideas of Keynes, considered the founder of “macroeconomics.” But as Yoram Bauman says, “microeconomists tend to be wrong about specific things, while macroeconomists are wrong in general.”

Unfortunately, much of the left has also embraced Keynesian theory because it can superficially appear progressive. This is the case, for example, with the proponents of a “Green New Deal” among the Democratic Socialists of America in the United States, or with Québec solidaire and their “Anti-Austerity Shield”.

We must however emphasize the problems with Keynesianism. In reality, Keynes was not a man of the left, and even less a socialist. He was bourgeois to the core. He was a member of the Liberal Party of the United Kingdom and openly represented the capitalist ruling class. “In the class struggle, you will find me on the side of the educated bourgeoisie,” he said.

Keynes is best known for his approach to economic crises. He criticized the classical economists who defended the idea of laissez-faire economics and argued that the market automatically organizes itself in an efficient way. For example, classical economists rejected the concept of involuntary unemployment, which they considered impossible according to their models. The reason there is unemployment, they explained, is that workers do not understand that they should accept lower wages. It doesn’t take a genius to understand how useful this idea is to the bosses.

Keynes rightly mocked laissez-faire advocates, saying, “The classical theorists resemble Euclidean geometers in a non-Euclidean world who, discovering that in experience straight lines apparently parallel often meet, rebuke the lines for not keeping straight.”

For Keynes, therefore, laissez-faire does not work. There is no invisible hand of the market that will balance everything. For him, the market cannot be left to itself. The state must intervene to regulate the market and correct the defects of capitalism.

He explains that economic crises are caused by underconsumption. He points out that involuntary unemployment causes a lack of demand. That is, the more workers are unemployed, the less money they have to buy goods. This lack of purchasing power limits demand, which limits the market for goods and causes firms to reduce their investments. The less they invest, the less they buy machinery and raw materials, which reduces demand, and the more they cut jobs, reducing demand even more. And so on, in a vicious cycle that always ends up triggering a crisis.

The Keynesian solution is to fill the gap in demand by government intervention. If workers do not have enough money, and companies do not want to invest, then it is up to the government to interrupt the vicious cycle by investing. He proposed large public works programs, such as roads and other infrastructure. The jobs created would get the ball rolling by creating demand. He explains:

“If the Treasury were to fill old bottles with banknotes, bury them at suitable depths in disused coal mines which are then filled up to the surface with town rubbish, and leave it to private enterprise on well-tried principles of laissez-faire to dig the notes up again (the right to do so being obtained, of course, by tendering for leases of the note-bearing territory), there need be no more unemployment and, with the help of the repercussions, the real income of the community, and its capital wealth also, would probably become a good deal greater than it actually is. It would, indeed, be more sensible to build houses and the like; but if there are political and practical difficulties in the way of this, the above would be better than nothing.”

Today, the trade unions and left-wing parties have largely abandoned socialist ideas and any revolutionary program. Instead of recognizing capitalism as the source of inequality and crisis, they argue instead that the problem is unregulated capitalism, so-called “neo-liberalism”. They therefore advocate Keynesian reforms and simply call for more public spending and regulation.

But it must be emphasized that there is nothing radical about these reforms. They are not really about ending exploitation and inequality. Keynes himself admitted this. “I believe that there is a social and psychological justification for large inequalities of income and wealth, but not as large as they are today,” he said in his General Theory. He wanted above all to save capitalism from its contradictions by reforming it.

Crisis of overproduction

In reality, economic crises under capitalism stem from the deep contradictions of the system. For Marx, economic crises do not originate in underconsumption or lack of demand, but in extreme abundance of supply, in what he called the “crisis of overproduction,” or what the utopian socialist Charles Fourier called the “plethoric” crisis.

Capitalism, in its early days, was a formidably progressive system. Competition between capitalists, i.e. the owners of firms, pushes them to want to acquire greater market shares by lowering their prices. To do this, they must constantly improve the productivity of their business, to produce more goods more quickly. They do this by investing in more efficient machinery and in technical and technological development. As a result, the economy and technology have developed more in the last 300 years than in the 2000 years before.

Thanks to this increasingly efficient, increasingly productive machinery, the capitalists produce an ever-growing quantity of goods for the market. But capitalists do not produce commodities for the benefit of the consumer, but to make profits.

These profits are made through the exploitation of the workers. They do not pay the workers for the full value of the sale of goods. The working class receives less in wages than it produces. And the difference in value is appropriated by the capitalists. This is the source of the exploitation of workers under capitalism.

The capitalists constantly try to increase this exploitation in order to get more profits. To do this, they seek to pay their workers as little as possible or to make their employees work as fast as possible. This exploitation is a source of misery for the working class, which is constantly squeezed like a lemon.

But it is also the source of economic crises. Indeed, capitalist exploitation means that the working class as a whole can never afford to buy what it collectively produces. Since workers are not paid the full value of what they produce, they do not have enough wealth to buy back all the commodities produced.

All this means that at one pole there is an exponential accumulation of commodities that must be sold, and at the other pole, a tendency to erode both the purchasing power of the masses and the number of workers. As Marx says: “The ultimate reason for all real crises always remains the poverty and restricted consumption of the masses as opposed to the drive of capitalist production to develop the productive forces.” (Marx, Capital, Book III)

This is what Keynes notes, without being able to explain it, when he speaks of a lack of demand, except that Keynes puts the problem in reverse. The capitalist crisis is not a crisis of underconsumption. The masses have always been very poor. Humanity has known famine and scarcity since its very beginnings. But capitalism is unique in that it enters a crisis about every ten years, not because of a shortage, but because of a surplus!

Of course, workers are not the only consumers. Part of the economy is devoted to the production of capital goods, i.e. machines, tools, equipment, etc. used in production. Capitalists constantly reinvest some of their profits in modernizing their machinery, in order to produce goods even faster and to replace their employees with machines. While this temporarily absorbs some of the supply, in the long run it only makes the problem of overproduction worse.

Friedrich Engels, Marx’s friend and collaborator, explains the crisis of overproduction as follows:

“The enormous expansive force of modern industry, compared with which that of gases is mere child’s play, appears to us now as a necessity for expansion, both qualitative and quantitative, that laughs at all resistance. Such resistance is offered by consumption, by sales, by the markets for the products of modern industry. But the capacity for extension, extensive and intensive, of the markets is primarily governed by quite different laws that work much less energetically. The extension of the markets cannot keep pace with the extension of production. The collision becomes inevitable, and as this cannot produce any real solution so long as it does not break in pieces the capitalist mode of production, the collisions become periodic. Capitalist production has begotten another ‘vicious circle’.”

Engels, Anti-Dühring

This overproduction explains why, on a planetary scale, about one third of the food produced is thrown away while one person in nine suffers from hunger. It is also the reason why the big fashion brands destroy tons of clothes every year while people are wearing rags. Goods are produced to be sold, to make a profit, not to meet human needs.

Periodically, the market becomes too saturated and the capitalists can no longer find buyers for their products. They stop reinvesting in machinery, which cuts into demand. They cut back on production and lay off employees. This cuts demand even more, and it becomes even harder to sell. The system then enters a crisis.

One statistic reveals this overproduction quite well. Capacity utilization, which essentially means the proportion of machinery that is used, is clearly trending down. For example, in the USA it was around 90 per cent in the 1970s. It has fallen below 80 per cent since 2008 and today it is around 75 per cent. While millions of people in the U.S. remain in need and 10 million people are unemployed, 25 per cent of the machinery is simply not being used, because there is no money to be made by producing more.

source: tradingeconomics.com

Who pays?

In light of this explanation of the crisis, the problem with Keynesianism becomes clear: who will pay for these large infrastructure programs? Where should the government get the money to stimulate the economy?

Of course, it can raise taxes. But then, who should it tax, the workers or the capitalists? If it taxes the workers, for example by raising consumption taxes or taxes on lower incomes, it does not solve anything. It only reduces their purchasing power and cuts demand even further.

Governments can also take money from the pockets of the capitalist class, as Keynesianists often propose. For example, Québec solidaire proposes to tax large corporations and fortunes over $1 million.

Of course, as socialists, we have no problem taxing the rich. We won’t cry if the Molsons have to sell one of their yachts. But, it must be emphasized that this is not the answer either.

As we have seen, bosses hire workers and produce for profit. More taxes on business only discourage investment by reducing the prospect of profits. Capitalists tend to relocate production in response to a higher tax burden.

Finally, the state can also finance its expenditures by running deficits, i.e. by borrowing money. However, this solution has a not-unimportant limit: creditors have an annoying tendency to want to be repaid, with interest. The government can therefore stimulate the economy, but at the cost of limiting its ability to stimulate it later.

In other words, if the government boosts demand today by running deficits, it cuts demand tomorrow. And as government debt grows, the problem gets bigger and bigger. Of course, proponents of modern monetary theory will roll their eyes at the idea that debt repayment will be a problem. We will come back to this.

None of this is to mention that Keynesian measures tend to exacerbate the crisis of overproduction. Supported by an artificial market created by money lent to the state, firms can continue to produce more and more. Capitalists can continue to invest in machinery and increase their productive capacity, and thus the quantity of goods on the market. So while government spending succeeds in filling demand for a while, it tends to worsen the crisis of overproduction in the long run.

The state is then caught in a trap: stop borrowing to fill the gap in demand and risk a crisis, or continue borrowing and accumulate more and more debt, with a corresponding growth in the gap between the purchasing capacity of the masses and the productive capacity of firms.

Austerity

Conservative politicians therefore generally oppose Keynesian measures precisely because they ask who is going to pay for them, and because they are outraged by the seemingly endless growth of the public debt. Their solution is then to cut public services, lay off public sector workers, reduce the social safety net, etc. In reality, this only makes the problem worse, by cutting demand further.

Marxists do not criticize Keynesianism because we prefer austerity. Not at all. The labor movement should fight against cuts to public services. Every reform won by labour is a good thing.

We often hear on the left that it is irrational to adopt austerity measures. Many social democrats, reformist left parties and organizations repeat the mantra that “Austerity is ideological.”

But as Marxists, we point out that austerity is just the other side of Keynesianism. Governments of both right and left that refuse to break with capitalism have to play by the rules of the capitalist game: debts must be paid off and private property must not be touched. Austerity therefore inevitably follows Keynesian programs.

In truth, then, both the Keynesians and their opponents are both right and wrong. Governments do have a choice. They have a choice between doing nothing and enduring the crisis now, or stimulating the economy with deficits and experiencing an even greater crisis later when debt repayment and austerity are inevitable. Austerity or deficits is a choice between a punch now or a kick tomorrow.

“We are all Keynesians today”

Today, the threat of austerity hangs over our heads like a sword of Damocles. Governments were already heavily indebted before the pandemic. With last year’s bailouts, public debt exploded, especially in developed countries. In the first two months of the pandemic alone, governments around the world spent more than $10 trillion on stimulus. This is three times the cumulative stimulus plans of 2008 and 2009. Global public debt increased by 15 per cent last year.

This massive spending prevented a complete catastrophe. But it did not solve anything. Since the pandemic began, we have seen an explosion in the number of zombie companies, i.e. companies whose revenues are insufficient even to pay the interest on their debts. In the United States, 20 per cent of the 3,000 largest companies listed on the stock market are teetering between life and death. The debt of these companies has risen from about US$400 billion in 2019 to almost US$1.4 trillion in 2020.

The truth is that the survival of the economy depends on the continued injection of money by the state, through programs like the Canada Emergency Wage Subsidy. These programs are nothing less than huge corporate handouts, a blank cheque until the pandemic ends. Large parts of the economy are essentially on life support. And for companies that don’t really need it, the government’s generosity is the perfect opportunity to put plenty in the pockets of their owners, like Imperial Oil Ltd, which received $120 million from Trudeau and paid $324 million to its shareholders.

But what happens when these bailouts end? The ruling class is worried. The more far-sighted wing of the bourgeoisie is calling to maintain the life support and warns that austerity would have dangerous economic and political repercussions. Laurence Boone, chief economist of the OECD, warned in an interview with the Financial Times in January that “the public would revolt against renewed austerity or tax increases.” After the crisis, “people will ask where all this money came from,” she said.

The International Monetary Fund (IMF) and the European Central Bank, two institutions that don’t exactly have workers’ interests at heart, are advocating the same idea. The IMF is calling on governments to “rethink” the rules of public finance and accept much higher levels of debt.

The ruling class has run out of ways to deal with the crisis. Desperate, they have no plan other than to accumulate debt until vaccination allows the economy to fully reopen. The Financial Times explained, “Nations’ first priority should be vaccination, while the reduction of public debt is now far down the list of urgent actions, according to the IMF.”

An ocean of liquidity

In addition to Keynesian policies, capitalist governments have a second weapon in dealing with economic crises: monetary policies. In essence, they promote investment and spending by improving the availability of money and encouraging borrowing. For example, in response to the Great Recession, the U.S. Federal Reserve gradually lowered its key interest rate from 5.25 per cent in September 2007 to around zero and 0.25 per cent in December 2008. This trend of reducing interest rates has been followed by Canada and the European Union, among others.

With interest rates around zero per cent, or even negative interest rates in some cases such as Japan and Switzerland, this tool is no longer available to the governments of most major economies. To encourage banks to lend and drive down interest rates even further, central banks have resorted to a monetary tool called quantitative easing (QE), which consists of buying up debt (usually government bonds). Canada, which had never used quantitative easing before, started doing so for the first time in March 2020, creating about $5 billion every week.

The severity of the crisis has led to previously unthinkable measures being taken. As part of its quantitative easing program, the U.S. Federal Reserve began to buy not only government bonds, but also private bonds. In other words, to encourage companies to borrow more to invest, the U.S. central bank bought up their debt.

“The result has been the biggest corporate borrowing spree on record,” says the Financial Times. Alex Veroude, chief investment officer at Insight Investment, interviewed by the British business newspaper, points out that with this policy, it is no longer important to check whether a loan is risky or not. He comments: “The Fed has created a bailout expectation. … If you think about it, it’s crazy. It’s exactly what critics would say capitalism has created. But that’s the reality.”

But that’s not all. In March 2020, the U.S. Federal Reserve used the atomic bomb: it ended fractional reserve requirements. Private U.S. banks could now lend without limit, without any obligation to keep a single penny in their coffers.

All this means that the market is now awash in liquidity. “It has never been cheaper for companies with a “junk” credit rating to borrow cash in the US.” It is a veritable orgy of credit creation.

Despite all the credit available, the cash is not being used to hire workers or buy machinery. For example, Canadian companies are currently sitting on $1.58 trillion in their bank accounts. Why invest when the market is already saturated with overproduction? Why produce more when you can’t sell? The prospects of profit are poor, so this money does not find its way into the real economy.

These monetary solutions have the effect of greatly increasing the instability of the system, without really increasing productive investments. Instead, cheap credit and vast amounts of liquidity end up in the financial market and in speculation. The amount of margin debt, that is, debt taken on from brokers for speculative purposes on the stock market, reached a record $799 billion in the U.S. in January 2021. Capitalists would rather gamble their money (or their creditors’ money) on the stock market than invest it.

This orgy of speculation is leading to fears of a stock market bubble, as we saw with the GameStop affair. Some compare the current situation to the Internet bubble of the early 2000s. A clear sign of speculation is that the market value of many companies is completely disconnected from their revenues. Tesla’s price/earnings ratio, for example, reached a staggering 209 earlier this year. The same price/earnings ratio averaged 40 for Nasdaq 100 companies, the highest since the dot-com bust.

The ruling class really has no solutions to offer us. The only thing they offer is more public debt, more private debt, and more money for capitalists who have no intention of investing it productively. No wonder some previously marginal ideas are beginning to gain in popularity.

Universal Basic Income

The idea of a universal basic income (UBI) gained ground last year. In a context where many people were being laid off indefinitely, the state had to step in to prevent a catastrophe. So UBI was put on the table with the big income support programs that were adopted with the first lockdown. In Canada we had the Canada Emergency Response Benefit, and then the Canada Recovery Benefit (CRB). The British got a paid leave program. The Americans got a nice $600 cheque…

In Canada, some have raised the possibility of making this benefit program permanent and universal, which is more or less a type of UBI: a government program that would give a regular amount to everyone, regardless of income. The Senate Finance Committee has recommended that the Trudeau government adopt a modified but permanent form of CRB. The idea of UBI even made its way into the Liberal Party of Canada. Delegates at the April 2021 party convention voted 77 per cent to pass a (non-binding) resolution in support of UBI. Even the Pope has come out in favour of UBI!

Proponents of UBI argue that one of the reasons it is being proposed is to respond to increasing automation and the “gig economy”—the growing casualization of work, especially for those at the bottom of the economic ladder. UBI thus aims to compensate for the problems of capitalism in crisis: the ever-increasing exploitation of workers and their replacement by machines—the two phenomena at the very source of the crisis of overproduction.

A section of the left has adopted UBI as a demand. For example, Québec solidaire, in its program, proposes to test a UBI pilot project. And the idea of fighting poverty by giving everyone a regular cheque, with no strings attached, can certainly be attractive and seem quite radical.

But like any other demand, one must ask: who benefits? Does it advance the interests of workers in the class struggle? In this case, we have to say: it depends.

Already, the fact that Liberal MPs are putting forward this idea should be a red flag. UBI is not a left-wing demand. It also has many supporters on the right, including the libertarian economist Milton Friedman, who inspired the economic policies of the Chilean dictator Augusto Pinochet. For the right, UBI has nothing to do with strengthening the social safety net.

On the contrary, it is a Trojan horse to dismantle the welfare state. The idea is to replace various social programs such as public health and education with a single benefit, in order to privatize public services. With the conservative aim of reducing the size of government and opening up new markets, they prefer for everyone to receive a payout that can then be spent on private social services.

When the right wing puts forward UBI, it is important to understand that they do not want everyone to have a truly sustainable income. The idea is to give the poor enough to not starve, but not enough to discourage them from taking bad, low-paying jobs. This is what they call the “welfare trap”, the vicious cycle of welfare.

Right-wing columnist Mario Dumont of the Journal de Montréal gave us an example recently, when he criticized the CERB for just this reason: “Our young people have seen that it is better to rely on government cheques than to work. This summer, many young people who chose to work ended up with less money than those who pocketed Justin Trudeau’s programs.” Too high a UBI would force employers to pay higher wages to compete with it, something the capitalists and their lackeys like Dumont cannot accept.

So, before even considering supporting the adoption of UBI, we would have to make sure that it is not a regressive measure and an attack on workers.

But even when UBI proposals come from the left, there is a caveat. For example, last August, New Democratic Party MP Leah Gazan tabled a motion in the House of Commons calling for the CERB to be converted to a UBI. She proposes to fund such a UBI by “ending subsidies to big business and tax havens, and taxing the ultra-rich.” She calls for the program to be accompanied by investments in public services, social housing, public health, etc.

However, it must be recognized that this demand comes back to the same problem as all Keynesian solutions: who will pay for it? It is utopian to believe that wealth can be transferred from the rich to the poor without a vociferous class struggle. And in the event of such class struggle, real programs like free education, free childcare, universal pharmacare, and a massive program to build social housing would have a far higher impact than a cash handout. Plus, the proponents of UBI present it as an alternative to the class struggle. Left-wing advocates of UBI are still essentially proposing to tax the rich, with the same problems we pointed out earlier.

Modern Monetary Theory

Some will say that Marxists are old-fashioned. Worry about the public debt? In 2021? For proponents of modern monetary theory (MMT), the notion that government deficits are a problem is outdated. This is what Stephanie Kelton, Bernie Sanders’ former economic advisor and MMT’s most prominent economist at the moment, calls the “Deficit Myth.” Kelton says, “the idea that taxes pay for what the government spends is pure fantasy.”

MMT has gained popularity in recent years on the left. The leader of the left wing of the U.S. Democratic Party, Alexandria Ocasio-Cortez, is a supporter. The Quebec-based left-wing think tank, IRIS, recently published a text on the subject.

What does modern monetary theory say? Essentially, MMT says that governments cannot run out of money. Or more precisely, they say this about governments that have monetary sovereignty, i.e. governments that issue their own fiat money. This is the case, for example, of the Canadian federal government, the American federal government, Japan, the United Kingdom, etc. Conversely, this is not the case in Quebec or European countries that use the euro.

The idea is simple: if the government issues its own money, it can always create more. It does not need to raise money through taxes to finance its social programs. Nor can it default on its debts, since it can simply print more, or rather, change numbers on the central bank’s computer.

But, as an early economist, William Petty, said in 1682:

“If the wealth of a nation could be increased tenfold by a simple ordinance, it would be very strange if our government had not enacted it long ago.”

William Petty, quoted in Capital, p.115, note 62

In reality, the state can create money, but it cannot ensure that the money has value. Modern monetary theory does not understand this fact. In fact, it does not even have a theory of value, or an explanation of the origin of value.

MMT, which is based on a theory called chartalism, defends the completely idealistic and frankly far-fetched idea that money is a pure creation of the state. The father of chartalism, Georg Friedrich Knapp, asserts that “money is a creature of the law.” It is because the state collects taxes in a certain currency that this currency is used!

But as David Graeber points out, “[John] Locke insisted that one can no more make a small piece of silver worth more by relabeling it a “shilling” than one can make a short man taller by declaring there are now fifteen inches in a foot.” The state cannot artificially fix the value of its currency, which is fixed by the market.

Instead, Marxism understands that money (in its contemporary form detached from precious metals) is only a representation of value, not value itself. Value itself is found in production. Commodities, i.e. goods and services produced to be sold, possess value because they are the product of human labor. The (fiat) money in a given economy simply reflects the value of the goods in circulation in the market.

If the state puts more money into circulation without a commensurate increase in the value of the goods in circulation, it merely reduces the value represented by the money. All other things being equal, if the government puts twice as many dollars into circulation, it devalues each dollar by half.

All of this means that, despite what some may say, the government cannot print money ad infinitum. There is a limit to how much money the government can create.

That limit is inflation, which is a general increase in prices, or in other words, a decrease in the value represented by money.

Inflation, by raising the price of goods, lowers the purchasing power of workers. Some inflation is not really a problem for capitalism, but when it gets out of hand, wages and investment have difficulty keeping up, and savings are eroded. Governments therefore tend to try to keep inflation at around two per cent.

A government that created unlimited money would cause an inflationary crisis, where money would quickly lose value. The best-known example of such a situation is Germany in the 1920s, where the government tried to pay off its debt by printing money. Money was then worth less than the paper it was printed on.

But MMT recognizes the risks of inflation. As Kelton says, “the limits are not in our government’s ability to spend money, or in the deficit, but in inflationary pressures and resources within the real economy.” In short, don’t break out the champagne too quickly. Money does not grow on trees.

So what is MMT’s solution to prevent inflationary pressures? Kelton explains: “At its core, MMT is about replacing an artificial (revenue) constraint with a real (inflation) constraint. […] Instead of starting with the premise that every dollar of new spending should be paired with a dollar of new revenue, MMT urges us to begin by asking, How many dollars should be subtracted away?” In other words, simply offset the addition of new money by taking money away from elsewhere in the economy. How? By… Taxes!

In short, the mountain—MMT is nothing less than a “Copernican revolution” in economics according to Kelton—has given birth to a mouse. We are back where we started.

The same problem arises as with more classical Keynesianism: who will pay? Who to tax to take money out of the economy?

Squaring the circle

All these solutions end up facing the same conclusion: if we really want to put more wealth in the pockets of workers, we will have to take it from the pockets of capitalists. No matter how you turn the problem around, it always comes back to this.

Except that the capitalists won’t let that happen. Touching the wealth of a capitalist is like taking a bottle away from a hungry baby—a gigantic baby that owns the factories, transportation, banks, etc., and has an army of lawyers, journalists and lobbyists.

A left-wing government that really tried to redistribute wealth through a Keynesian program or a universal basic income financed by taxing the capitalist class would face enormous resistance from the capitalist class. Capitalists would close their factories in protest. They would withdraw their money from the banks. There would be capital flight. They would throw millions of workers out of work.

This government would then have little choice. It could capitulate and abandon its reforms, and then govern on behalf of the capitalists, who would demand that it implement austerity—this is what happened to the supposedly far-left Syriza government in Greece, for example.

Otherwise, it would have to directly attack the source of the capitalists’ power, i.e. the private ownership of the means of production. It would then have to seize the big companies, the banks, the means of transport, communication, etc. and nationalize them. The two choices available would therefore be: socialism or austerity.

There is no magic way out. Private property is at the root of crises of overproduction. Any government seriously trying to solve the crisis would inevitably run into this wall.

Faced with a generalized crisis, capitalists do not want to invest. They don’t want to create more jobs, because their profit possibilities are rather limited. So we have to say: too bad for them. They don’t play any useful role. We have to expropriate them, and restart production under the control of the workers, so that the needs of all people are met.

There is no lack of resources or wealth. There is plenty of food, housing, everything needed for everyone. But a small minority of the ultra-rich are taking this enormous wealth into their own hands.

This parasitic class clings to society with all its might as a huge leech that crushes us with all its weight. And while it is dragging us into the abyss, some people calling themselves leftists are looking for all sorts of increasingly sophisticated ways to avoid touching the leech on our backs, or to not bother it too much. With their reformist “solutions”, politicians and union leaders are essentially promising us that they have managed to square the circle.

For a socialist solution!

The labor movement, the workers, should not be fooled by the false solutions of Keynesianism, UBI and MMT. It is all smoke and mirrors.

Of course, we support any reform that improves workers’ lives. The struggle for reforms is part of the revolutionary struggle. Every reform won by the workers’ struggle gives the workers even more confidence in their own strength, and puts them in a better position in the struggle against capitalism.

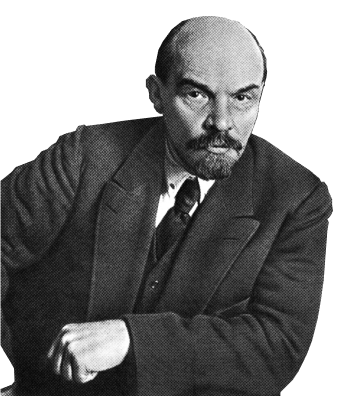

But the first task of revolutionaries is to say what is. As Lenin said, only the truth is revolutionary. It must be said openly that Keynesianism, MMT, and UBI cannot solve the crisis. At best, these solutions are only a band-aid on a system that is dying of cancer.

They do not address the deep contradictions at the source of the crisis of overproduction. They do not question the private ownership of the means of production, the market economy and the exploitation of workers. They do not prevent the capitalists from producing more and more commodities while they impoverish more and more workers.

Proponents of these ideas want to attack inequality without attacking the source of inequality, that is, the fact that the rich are rich because they own the means of production and capital, and that the workers own nothing but their labor power and are therefore poor because they have no other means to survive than to sell themselves to the capitalists.

When some on the left claim that it is possible to have a big welfare state, a universal basic income, an end to austerity, etc. without socialist revolution they are essentially saying that it is possible to have capitalism without recurring crises. They affirm that it is possible to have a capitalism that does not sow misery. They say that capitalism can offer us wealth without poverty. They are essentially telling us that a society based on exploitation can exist without exploitation.

So we say, “Let’s stop circling the drain!” Capitalism is leading us straight to catastrophe. We must change direction before it is too late. The unions and the workers’ parties should stop making excuses for this rotten system. It is time for the working class to return to a revolutionary program.