A bankruptcy crisis is looming over the world. The New York Times has called it “a debt crisis unlike anything we have seen”. This isn’t the threat of a handful of banking behemoths going under, however, but rather of entire national economies. Some 54 low and middle-income countries are today teetering on the edge of bankruptcy.

National bankruptcy ushered in a near 8 percent GDP collapse of the Sri Lankan economy last year. The consequences involved atrocious suffering for the masses in that country. Now, similar agony is being prepared for millions of others. How did this global debt crisis emerge? When reading about it in the capitalist press, you could be forgiven for imagining that it’s all down to sheer recklessness of governments in poor countries. The truth is that the whole thing is the product of a conscious policy of pillage by the finance capitalists of a handful of wealthy creditor nations.

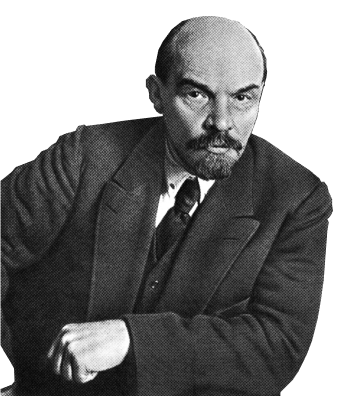

In his 1916 masterpiece Imperialism: the Highest Stage of Capitalism, Lenin explained how “the world has become divided into a handful of usurer states and a vast majority of debtor states.” This debt, he explained, forms one of the cornerstones of “a world system of colonial oppression and of the financial strangulation of the overwhelming majority of the population of the world by a handful of ‘advanced’ countries.” These words might have been spoken yesterday.

When COVID-19 broke out, it ravaged poorer countries. As well as killing millions, it caused exports and remittances to dry up. But the poorest nations did not have the reserves necessary to weather the storm. They were then punished a second time, as the $20 trillion pumped into the world economy to keep capitalism afloat – primarily by rich nations – fed into inflation and higher import prices.

They are now being punished for a third time, by measures like interest rate hikes that are being used by western governments to bring inflation under control domestically. With higher interest rates, the cost of borrowing has spiralled. Meanwhile, the relative strengthening of the dollar has massively increased the burden of dollar-denominated debts.

These woes are pushing up the cost of borrowing for poor nations. Interest rates on new borrowing by low income nations have increased by an average of 6 percentage points in the last year, three times faster than that of US government borrowing. Nine low-income countries are only able to access private lending markets at over 20 percent interest, whilst another 10 have to pay more than 10 percent.

Among the poorest countries, debt repayment saps an average of 16 percent of government revenue, up from 6.6 percent a decade ago. But for Sri Lanka, that figure is 75 percent, in Laos 67 percent, Pakistan 46 percent, Angola 36 percent, Tunisia 30 percent, with many others in a similar category. Just as the poorest families that are least able to afford debt repayments are targeted by loan sharks and ‘payday’ lenders charging the most outrageous interest rates, so the big international lenders are most brutal in squeezing precisely those least capable of paying.

These are absolutely unsustainable debt levels. Defaults are inevitable. 21 countries, home to over 700 million people, are already in default or are seeking restructuring. A series of dominos have been lined up and they are ready to fall.

The strategists of imperialism are extremely alarmed – not merely for their investments, but also because of the looming social consequences.

Last year, default in Sri Lanka led to the country being locked out of credit markets. Foreign reserves quickly dried up, making it impossible to import fuel and other essentials, and so the country experienced runaway inflation and massive shortages. This led to an explosive revolutionary movement. More recently, in February, IMF conditions imposed on the small Caribbean nation of Suriname, following a default, ended with the masses storming the legislature. And this is just the tip of the iceberg.

The situation is desperate. It is doubtful if even large-scale and coordinated action by the largest imperialist creditors could avert a chain of events with revolutionary repercussions. Yet, like hyenas fighting over a carcass, the imperialist creditors are unable to agree on anything.

Three years ago, Zambia defaulted on its debt and is still in default now because creditors cannot agree on how to restructure the country’s debt. One year ago, Sri Lanka defaulted. Although an IMF deal has been struck in the latter case (involving enormous austerity, privatisations and regressive taxation to make the poor, working and middle classes pay), the deal remains provisional on an agreement being reached between creditors on debt restructuring. Here too, negotiations have threatened to run aground.

The rise of private lenders

All the aforementioned was foreseen well in advance. As the pandemic unfolded across the globe, the strategists of Capital were alarmed about what this might mean for poor and indebted nations. Schemes were set up, supposedly to mitigate the pandemic’s consequences for debt repayment, but they soon broke down.

The Paris Club of western governments established a scheme for the suspension of some debt payments, yet strangely found debtor nations unwilling to accept their largesse. Why? Because the latter were terrified that private lenders would see failure to repay creditors as a default, leaving a black mark that would mar their chances of accessing private credit markets in the future. Such is the dictatorial power of the big investment banks.

When the Debt Service Suspension Initiative (DSSI) was established by the G20 during the pandemic to deal with the danger of default, they faced another problem: not a single private lender agreed to participate. This was a serious problem.

In the past, when a country became debt distressed, western lender states and western multilateral organisations like the IMF would form an agreement among themselves to ‘restructure’ debt repayments.

Creditors would mutually agree on who would take a ‘haircut’ (i.e. write off) and by how much on debt deemed to be unrecoverable. On the basis of such an agreement, the IMF would offer an emergency loan to extricate an insolvent government, but these loans would be tied to austerity programmes aimed at making the poor and working class pay. Capital would benefit twice from these ‘rescues’: firstly, by recovering as much of their money as possible by squeezing the working class and the poor; and secondly, by preparing the working class for even-more brutal (and profitable) exploitation going forward.

But it all hinged on the creditors forming an orderly queue in the first place, so that they might each retrieve their pound of flesh in turn. But whereas in the past, western states and institutions like the IMF and World Bank were the main international lenders, as of the past decade a swarm of private lenders, like a plague of locusts, has descended on poor and middle-income countries.

Since the financial crash of 2008, huge amounts of cash has been poured into the coffers of private finance houses by governments through quantitative easing. With few outlets for profitable investment, much of this money was lent at usurious rates to poor and middle-income countries by the likes of HSBC, Blackrock, UBS and JP Morgan.

According to the Financial Times, between 2000 and 2021, the share of external debt of low and middle-income countries to private vultures rose from 10 to 50 percent, while the share of official western state lenders fell from 55 to 18 percent.

And these private lenders haven’t yet been observed forming an orderly queue, even when it concerns their own interests. Like a flock of vultures, they simply strip their victims bare and move on. Now, they are refusing to take write-downs on bad debt, and are forming an enormous hindrance in debt restructuring negotiations.

The fishy business of ‘Tuna Bonds’

We will give just one example here of how a little of this debt was incurred, and the odiousness of the methods used by imperialist finance capital to crack open and scoop the wealth out of poor nations.

In 2013, Middle Eastern businessmen and western banks – including the recently bailed out Credit Suisse – organised a $2.2 billion loan for Mozambique. That is no small sum for one of the world’s poorest nations. What then happened to the money?

Firstly, it was the Mozambican president himself, Guebuza, who signed the deal, completely behind the back of the public and parliament. Of that cash, $150 million has now been traced to bribes and kickbacks, including to Credit Suisse employees. Another $500 million simply disappeared – we can assume it was used similarly. And the rest was used for its assigned purpose: ‘development’ investment. And this is where things get even fishier. Specifically, this enormous sum was used to buy 24 tuna fishing vessels from a French-Lebanese shipbuilder at a price tag enormously in excess of their real value. The vessels were never used and are now rotting in a port off the country’s coast.

All parties made a handsome profit… except the Mozambican people, who only learned of this debt, contracted in their name, when the president left office in 2015. Such was the scale of the debt that it caused economic collapse and a default in 2016. By then, Credit Suisse had already packaged up and sold on the debt for a tidy profit.

They were later punished in courts. And what were they ordered to do? To pay $500 million in fines… to British and US authorities! So the UK and US governments also made a tidy profit on the whole thing. Meanwhile, Credit Suisse was made to pay just $22 million in restitution to the Mozambican people, despite the fact that the whole affair cost the national economy an estimated $11 billion.

Presently, Mozambique is trying to take Credit Suisse to court, and the two are tussling over whether the case will be heard in a British or French court. So, in summary, western investors bribe a president to defraud an entire nation, making a massive profit; western governments then take a cut of the cash; and now those same western governments, acting as bailiffs for the banks and investors, will pass judgement on whether Mozambique has to continue to repay this odious debt!

This is just one of an uncountable number of crimes committed by the giant finance houses of western imperialism that have descended upon poor nations, particularly over the last decade and a half. Instead of investing in any productive development, just as Lenin explained one hundred years ago, they use their overwhelming financial might to defraud and swindle, and to strangle the poorest nations on Earth.

Blaming China

These private lenders are now playing havoc in the unfolding debt crisis. Unlike government and so-called ‘multilateral’ lenders like the World Bank and IMF, they care very little for broader geopolitical and social considerations.

Their loyalty is to their shareholders alone, and they are therefore refusing to take ‘haircuts’ when the inevitable happens and unpayable debts lead to default. It was precisely the refusal of private bondholders to accept a write down on loans to Zambia that led to it becoming the first African country to enter default since the outbreak of COVID-19 in November 2020.

All the more hypocritical therefore are the howls in the western press placing all the blame for the deadlock around restructuring… on China. China, we are told, is engaged in a new and nefarious type of diplomacy, ‘debt trap’ diplomacy – i.e. it is deliberately extending unpayable levels of credit in order to wring political concessions and grab strategic infrastructure.

Fundamentally, however, China is behaving no differently to any other imperialist creditor. Like the others, they want to be paid back for their lending, in full and on time. And like the others they use debt as a means of gaining political leverage. But this is no different to the behaviour of the West. Indeed, a 1999 study already found that a country aligning itself with the US at the UN correlated with better odds for getting IMF bailouts, and more lenient treatment when flouting IMF conditions. Conversely, for every 1 percent of GDP borrowed from China, a country becomes 6 percent less likely to reach a deal with the IMF.

What has fundamentally changed – thus explaining the hue and cry of the West – is that Chinese lending has broken the monopoly of the ‘Paris Club’ of western creditors.

China has emerged as a third major player in the lending market to poor and middle income nations, alongside western-based private lenders, and official western creditors including so-called ‘multilateral’ lenders based in the West like the IMF and World Bank. Today, at least 65 countries owe more than 10 percent of their debt to China.

In the case of Zambia and Sri Lanka, where debt restructuring negotiations had stalled, China holds a minority of the debt (a third in Zambia, a fifth in Sri Lanka). Yet the western media has tried to throw the entirety of the blame onto China.

Increasingly, the People’s Bank of China (PBoC) has itself stepped in as an emergency lender of last resort, parallel to the so-called ‘non-partisan’, ‘multilateral’ IMF, which is in reality a mere tool of US imperialism.

In debt restructuring negotiations that have traditionally taken place under the auspices of the Paris Club, multilateral institutions like the IMF are exempted from haircuts. The PBoC is not placed on the same footing. Meanwhile, private western lenders are simply refusing to take haircuts.

China is therefore (not unreasonably from the point of view of its own interests) refusing to accept a haircut so long as western creditors refuse to do likewise. But the IMF is refusing to step in with emergency lending unless China acquiesces, because they have no intention of lending money that will be used to repay Chinese lenders.

Compounding this conflict is the depth of the crisis. With China suffering its own slow-motion ‘subprime’ crisis, and western banks being roiled by crisis since the start of the year, all sides are fearful to write off foreign lending lest it trigger a renewed financial crisis at home.

The result is a tendency towards deadlock. Impoverished nations, languishing in default, are being more-or-less indefinitely locked out of international credit markets because their imperialist creditors cannot agree among themselves.

Debt as a weapon

As explained in an article in the Economist titled, ‘The IMF faces a nightmarish identity crisis’ – western imperialist creditors are entering uncharted territory.

During the last great debt crisis of poor nations in the 1980s, the Soviet Union was collapsing and US imperialism was emerging as the only great power on a world scale. This is the first occasion where the IMF has confronted a debt crisis like this amidst bitter competition between imperialist rivals.

As the Economist explains, this is the first time it has had to “confront head-on the contradiction of being an American-born, American-dominated institution that sees itself as the property of all nations. It is a contradiction that now looks impossible to escape.”

In the opinion of the Economist, the only option open to the IMF is to declare economic war against China, pressuring indebted nations “to default on Chinese loans today and not borrow from China again anytime soon.” In other words, it must drop the fiction that it is an impartial arbiter of world capitalism, and must become the open tool of US imperialism.

In short, whereas US imperialism once used its overwhelming weight to impose its solution to credit crises, as on other fronts it is finding itself challenged today by other imperialist creditors, and they are all fighting among themselves for the right to pillage the poor.

Here and there, they may come to an agreement on jointly butchering their victims. Indeed, a restructuring deal in Sri Lanka looks to be close, in which the workers’ pension funds will be sacrificed to the joint creditors. Elsewhere, where agreement cannot be found, deadlock is plunging poor and middle income countries deeper into an economic morass. The ‘solution’ to this deadlock for the imperialist creditor nations involves ever-greater belligerence with their rivals, using indebted nations as pawns in their games. This will only further the fracturing of the world economy.

All roads, under these circumstances, lead to ruin for the poorest nations on Earth. All roads lead to a deepening of the crisis of capitalism and to powerful revolutionary explosions of the oppressed masses to smash the chains of debt and slavery that capitalism has forged to bind them.